- Milk Road Degen

- Posts

- 🥛 The market’s getting frothy 🔥

🥛 The market’s getting frothy 🔥

Time to rotate.

GM. This is Milk Road Degen, the only thing more balanced than your new portfolio... until the next pump.

Here’s what we got for you today:

✍️ The rotation window is wide open

🍪 Brand coins are popping off like crazy

Milk Road Swap is a DEX that makes trading crypto simple, cheap and fun. Trade on Milk Road Swap now.

Prices as of 8:00 AM ET.

THE ROTATION WINDOW IS WIDE OPEN (P1)

Listen degen.

I am no master of the wicked arts.

I have no crystal ball. I am not a wizard.

Most of my crypto wisdom is third party; I simply listen to the top voices in the space and combine it with my own gut instinct.

And boy, are those voices getting loud.

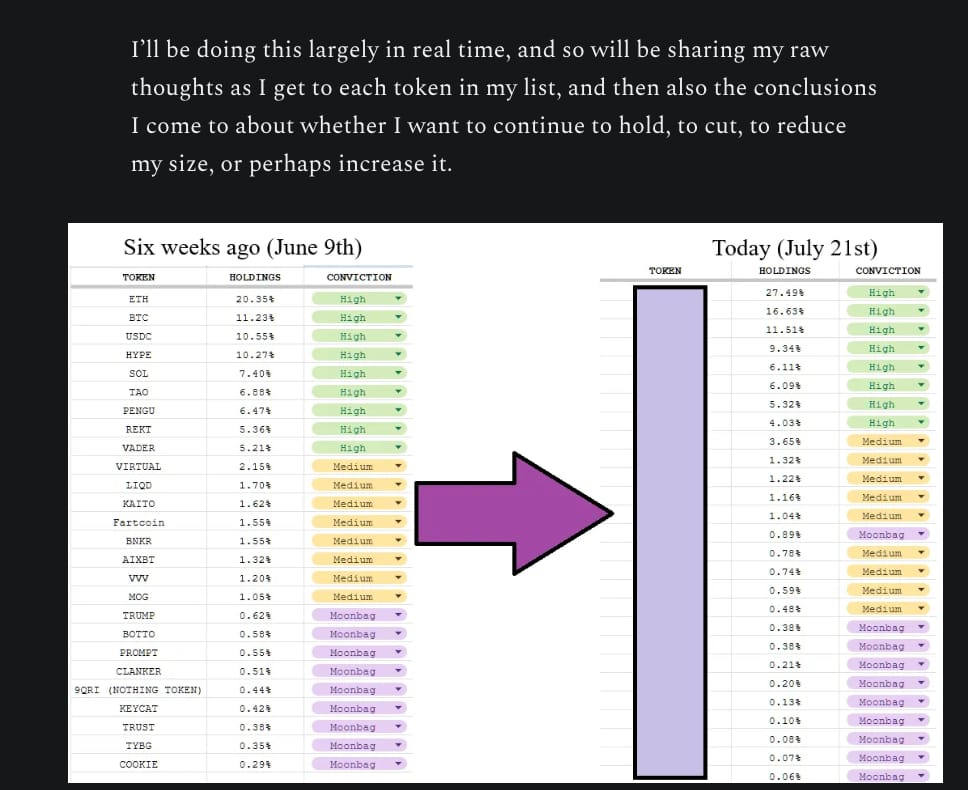

Just two days ago, the legend Zeneca wrote this note about his portfolio allocation. He teased that he had recently re-allocated his top holdings.

And with the market getting into really high gear, it’s as good a time as any to get organized.

Today we’ll look at:

How to allocate degen assets

Where we are at in the cycle

The state of degen assets

My own allocation

Let’s dig in.

How to allocate degen assets

A few years back, I had Scott Melker on my old podcast.

This dude nearly laughed me out of the studio when I told him I had a podcast entirely about NFTs. But he was very kind and direct.

I asked him straight up, as a career jpeg holder: what should a crypto portfolio look like?

He said:

70% majors

15% stables

15% “degen shit”

It was clean. Simple. Smart. A framework for knowing how much exposure you should have to shitcoins versus $ETH. And while I didn’t always follow it (R.I.P. my NFT bags), it helped me think more critically about how much risk I was taking on.

Fast forward to today and Zen’s portfolio, as of June 9th he held:

43% in “majors”

11% in stables

52% in “degen shit” (a.k.a. all the other stuff)

So the lesson here: land somewhere between a pro trader’s 15%, and the master degen’s 52%.

Game on.

Where we’re at in the cycle

Some call this the golden bull. The memes are definitely reflecting it.

Others are eyeing a top this fall. Or early 2026. Or maybe even sooner.

Personally? I hope the golden bull crowd is right. But I’m trading like the top’s coming fast.

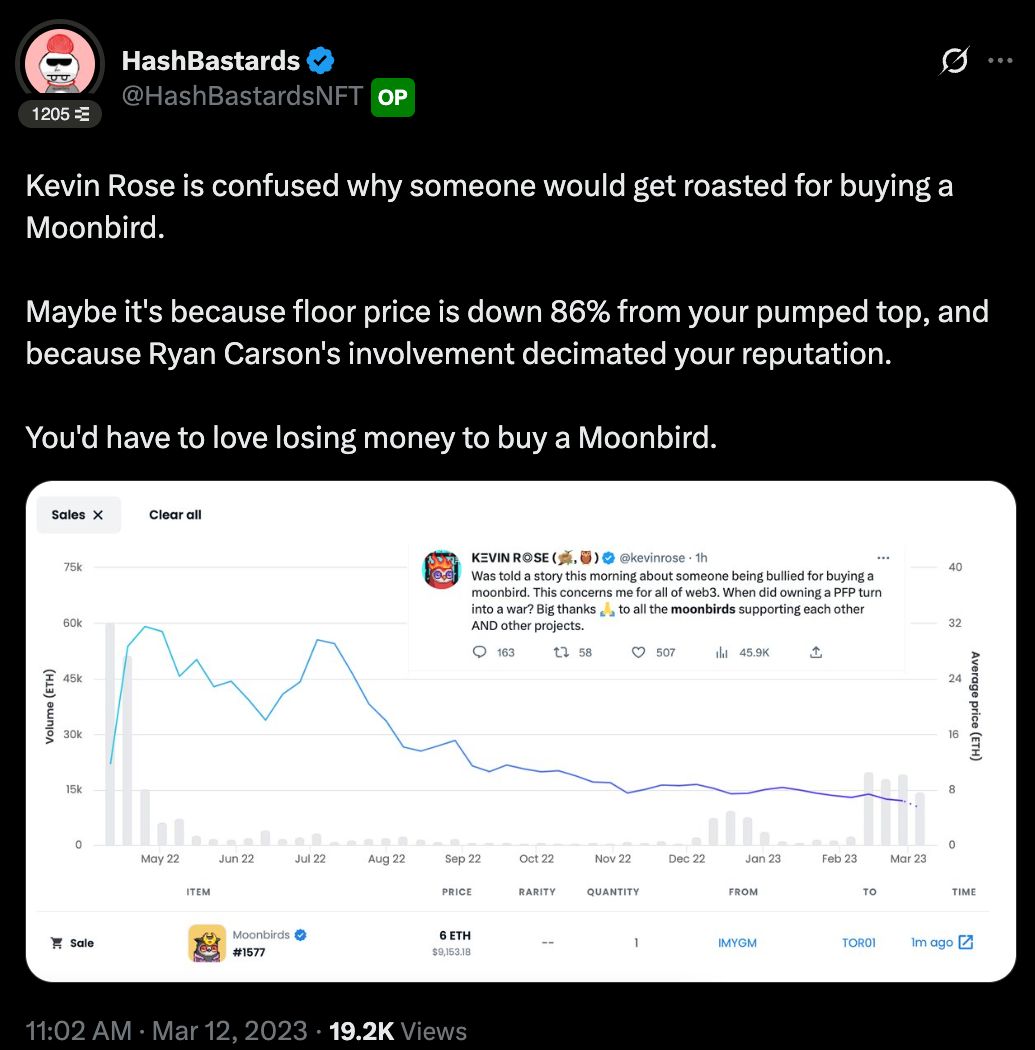

Why? Because this phase of the market smells a lot like the last hurrah moment from 2022. Back then, Moonbirds launched at the very top: a shiny new NFT project from Kevin Rose that Silicon Valley couldn’t resist. Floor hit 100K. Bags got heavy. We know how it ended.

(Don’t worry, it got much worse than that. Plus that tweet is TWO YEARS OLD)

I think we’re near that phase again. Where the market needs one final narrative to let the sidelined capital ape in before the curtains close.

Maybe it’s $PENGU, maybe it’s the Abstract TGE (slated for Q4), maybe it’s a new meme that hasn’t dropped yet. But I’m convinced we’re close to seeing one or two more huge liquidity moments before the slowdown.

Sidenote: I really thought the $PUMP TGE would be this big “liquidity event” but it never really materialized and that token has fallen way off. But that doesn’t mean the narratives are done.

You’ve probably used Uniswap for memecoins on Ethereum.

…and you’ve likely used Raydium for Solana memecoins.

But what if you could combine them into one?

Milk Road Swap supports both Ethereum and Solana trades in a single interface – plus…

It’s cheap: 0.15% fee + MEV protection on all Ethereum ecosystem trades

It’s simple: Need help finding a token? Don’t know how to get crypto in your wallet? How do you bridge from one chain to the next? We have guides and resources to help with all of this, built right into the interface

It’s fun: Goes ‘mooo’ when you swap (seriously)

Stop fumbling through onchain trading and try Milk Road Swap now.

THE ROTATION WINDOW IS WIDE OPEN (P2)

The state of degen assets

So the big question is this: should we be holding memes? AI? Launchpad tokens? NFTs?

Let’s dive into each asset and its current state of affairs:

1/ Memecoins

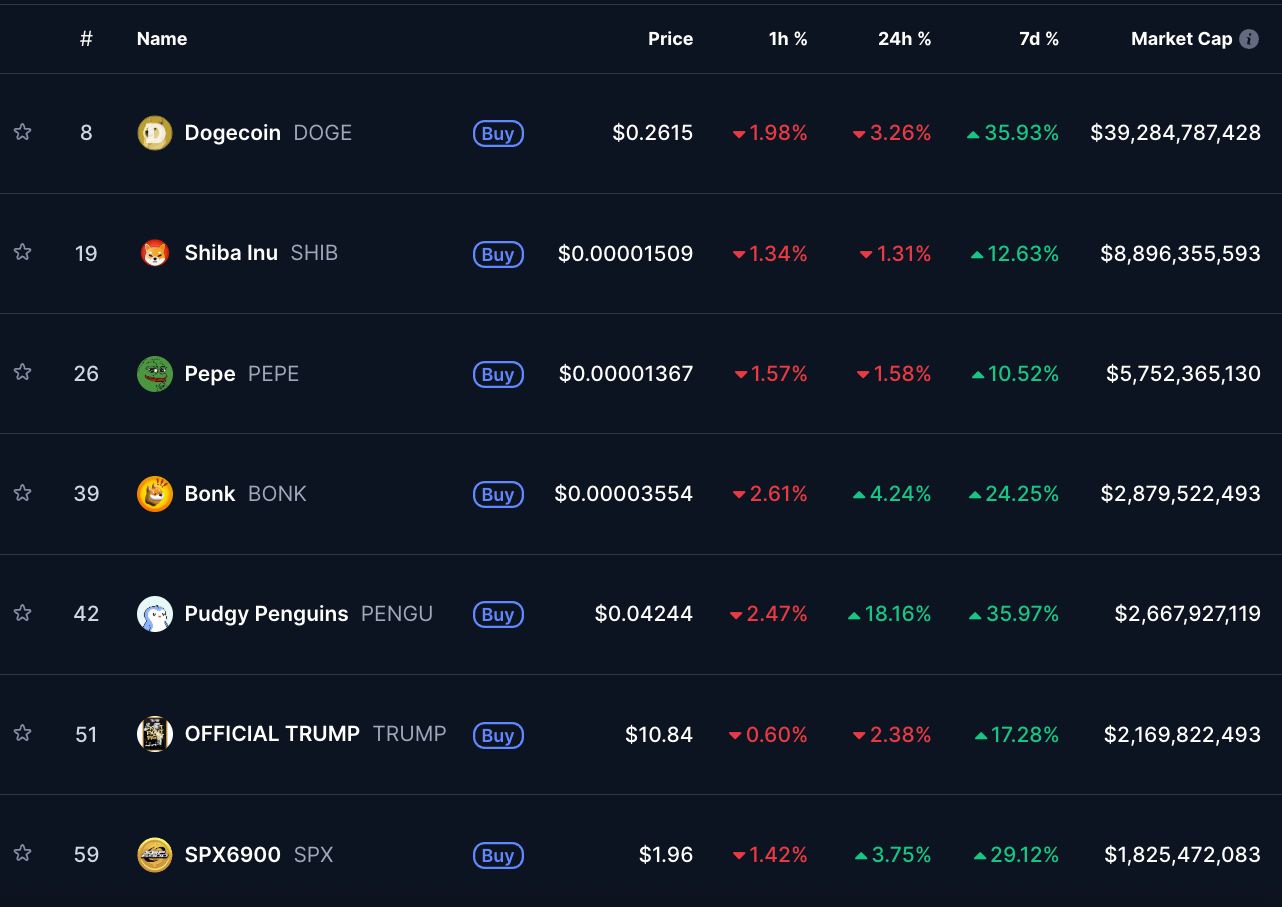

Many are up 2-3x in just a few weeks, and if your bags aren’t up at least 10-30% it might be time to rebalance. Or really double down on the coin you believe in. Either way, all eyes are on the leaders as they flirt with ATHs and look to break out.

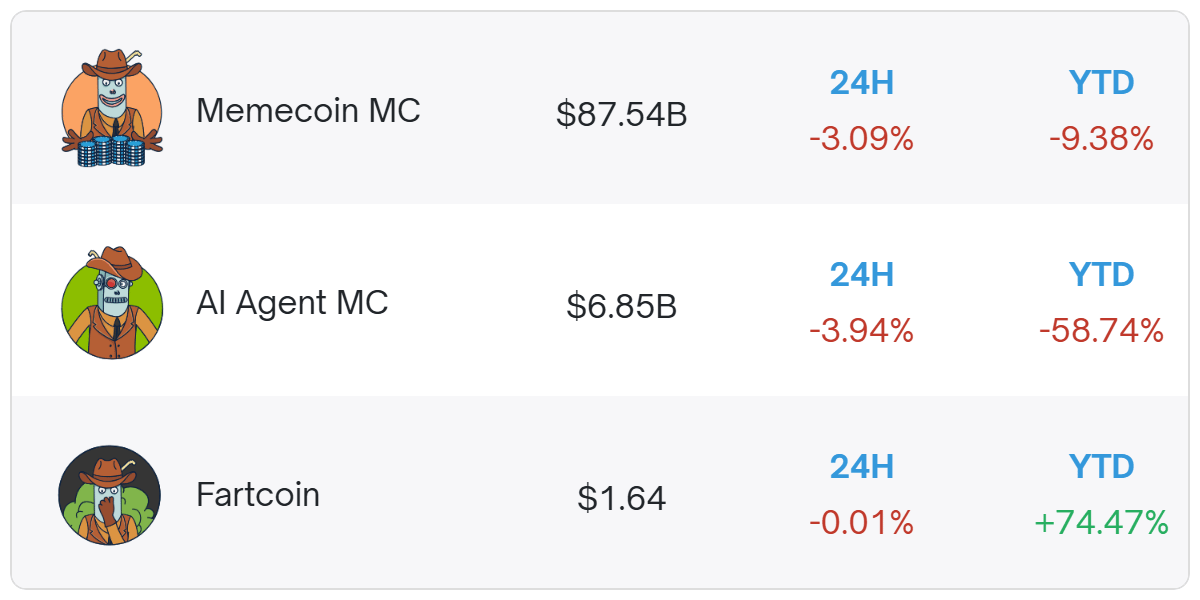

2/ AI Agents

Despite the broader AI trend cooling, top agents like $AIXBT and $MAMO are seeing strong runs. The agent market cap is up. $BNKR just pumped due to a Coinbase listing. $ADM just hit a 10x and is tied to an ex-Coinbase fund manager. There are still SOME gems to be had here.

3/ Airdrop farming

Still viable, especially if you’re parking funds in places like HyperLiquid, Abstract, or any other promising protocol. Even if that means buying NFTs, staking $ETH, or simply investing your time.

4/ NFTs (briefly)

$ETH pumped, and some NFTs followed with 2-3x moves. But be cautious. Utility is mostly gone, and you’re probably better off just holding $ETH.

5/ Launchpads

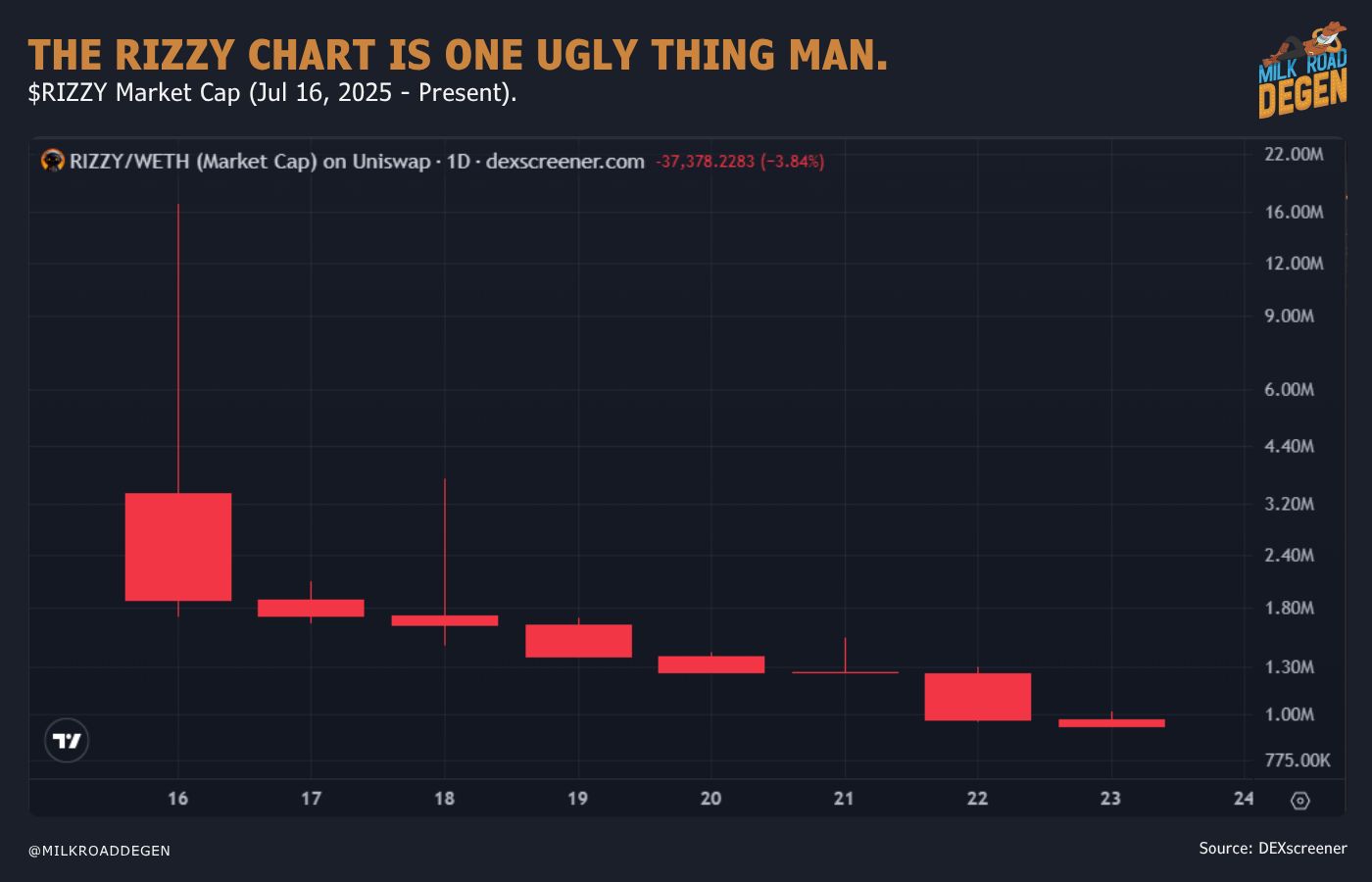

CreatorBid launched $RIZZY last week and it flopped. Kaito just revealed their first project launch, but it comes with a 12-month lockup which is the most anti-degen thing ever.

My current allocation

Don’t shame me for this. Here’s my current portfolio:

I play conservative because I got wrecked last cycle. I held my bags all the way down. This time, I sold early and often. Less upside, but way more peace of mind.

I took profits in January, dumped a chunk of AI that I’d bagged up, and haven’t ape’d back into any memecoins or altcoins. I am dabbling in new stuff, like getting into the PumpFun presale and locking a 40% gain. Not massive, but I went in with size and I’m happy with it.

TLDR: Ready to deploy capital, but getting out of trades quickly. The time to really go shopping was in April, and FOMO won’t get me this time.

Wrapping up

Every day I’m hunting for the next breakout.

Sometimes that means a wild meme token with momentum. Other times it’s a solid AI agent with a sneaky listing coming.

If you want to hear about it first, be sure to sign up for Milk Road Degen PRO.

Because remember: no matter what the cycle says…

We’re all just out here trying to figure out what to do with our bags.

Now I’d love to hear about you:

How are you structuring your crypto portfolio? |

Brand coins are popping off like crazy. $REKT and $PENGU lead the rally, both up +30% this week.

BonkFun hits an ATH on fees. A huge portion of these go to buying the $BONK token, which is up 30% this month.

Notable finance figure Balaji launched a “Creator Coin” on Zora. The price of the platform token is up over 2x as a result.

RATE TODAY’S EDITION

What'd you think of today's edition? |

MILKY MEME 🤣

ROADIE REVIEW OF THE DAY 🥛